|

Advantages of Factoring

August's Feature "The article leaves me thinking about the wonderful complexity every small business displays. Being educated as an engineer, I do love my models, but to understand a business and its performance, since each business is faced with its own unique set of circumstances, you have to dig into each business individually to understand it. I think this gives great insight to why lending to businesses is so different than lending to consumers. I believe consumer behavior can be modeled fairly accurately, but a business is just too complex." Dylan Morgan, Executive Vice President, Prairie Business Credit What Others Are Saying About Us "Prairie Business Credit quickly assessed an existing borrower's financing needs, and they refinanced us out of that difficult credit. They closed what they proposed, and we've added them to our bank's possible refinance lenders in the Chicagoland marketplace." - Bank C&I Workout Leader 25 Years Has Taught Us... After being in business for 25 years, financing over 500 companies, graduating 70% of them to be bankable clients, we have learned a few things along the way.

"The importance of humor for the entrepreneur. I have always viewed entrepreneurs with a good sense of humor as also being humble and learners. They laugh to acknowledge the limits of their ability to predict their hoped for outcome of success. It impresses me that laughter is an acknowledgement that there exist many things beyond out control. And when those unpredictable situations encroach on our best laid plans they can be responded to with frustration or reluctant acceptance or the humility of self deprecating laughter. Laughter seems to me the most honest and healthiest of reactions. Its an open acknowledgment, regardless of the confidence with which we predicted our solo success, of our minimal understanding of the huge number of variables that must be commanded to achieve success as an entrepreneur. Laughing at our business struggles recognizes that only time and honest assessment and changed behavior will lead us to competent outcomes more than half the time. So I've found it's best to laugh and learn." - Trevor Morgan, Founder & President, Prairie Business Credit

0 Comments

How Does Factoring Work? Prairie Business Credit meets with you to help assess the company's cash needs. An application is completed and a processing fee is generally charged. Within a few days, we complete due diligence and review receivables in order to fund. We purchase collectible receivables for goods or services which have been completed, delivered and invoiced. Typically, Prairie Business Credit advances cash for 60-85% of the face value of the invoice. Your company gets immediate access to cash without waiting 30-120 days for the invoices to be paid. Upon acceptance, you may receive funding within 24-48 hours. Prairie Business Credit is reimbursed by collecting your invoices. Factoring is most often used as a stepping stone, to get your company in the position to take advantage of growth opportunities. Once your financial position makes your company more "bankable," you may qualify for more traditional means of long term financing. July's Feature "I started Prairie when I was 46 and reasonably confident that I'd gained experience after 20 years in lending to reasonably assure our success. As all entrepreneurs know, starting a business is a journey of learning and no amount of training perfectly prepares you for the reality of making all the decisions when your own bank account is at stake in being correct. As a lender I am always more confident of taking on a customer who is experienced broadly in their specialty and biased towards those who have successfully navigated a downturn or two. Gaining that experience simply takes years and there is no substitute. This study confirms what our own anecdotal experience has been." - Trevor Morgan, CEO & Founder, Prairie Business Credit What Others Are Saying About Us "Prairie Business Credit quickly assessed an existing borrower's financing needs, and they refinanced us out of that difficult credit. They closed what they proposed, and we've added them to our bank's possible refinance lenders in the Chicagoland marketplace." - Bank C&I Workout Leader 25 Years Has Taught Us... After being in business for 25 years, financing over 500 companies, graduating 70% of them to be bankable clients, we have learned a few things along the way.

Good bookkeeping is invaluable. Your financial statements are like your scorecard. Without getting good immediate feedback about how your company is performing, you are operating blind. How can you fix things when they are wrong? How can you do more of what is working? There is no substitute for good bookkeeping and success without it will be elusive. It's a seller's market for employees Words never before printed or even dreamed of in my lifetime by Bloomberg, June 5, 2018: “Job openings exceed those looking for work”! Like all news of plenty, there are downsides. In this case for anyone hiring who is looking for experienced and talented workers the availability of qualified help is very thin. It’s a sellers’ market. Good for employees and tough competition for employers. For small companies the difficulties in this kind of market are magnified tenfold. There is one absolutely common, huge problem for all entrepreneurs: hiring competent employees. There is almost no trauma our client’s have experienced that we haven’t. We’ve lost clients/customers money, we’ve been defrauded. We’ve had capital and borrowing problems. But none has had the power and effect of trying to hire good long term employees. The numbers are a cool objective explanation from a distance but nothing compares to the emotional and non objective toll a good or failed hire take on a small entrepreneurial company. When a company of 10 hires one employee, they’ve increased their work force by 10%. Boeing would need to hire 14,000 plus for the same effect, all on one day. We and our small clients have lost key employees and it's been enormously disruptive. We've hired some great employees and they've have an immediate positive affect. Our clients usually have fewer than 50 employees and their losing one key employee out of 50 is roiling. That is magnified tremendously as the total number of employees decreases. The one thing all of our thousand plus clients and prospects have agreed on over the past 25 years agree on is that finding reliable and productive employees is their single most nagging challenge. A friend who worked for several Fortune 500 companies in his 45 year career said the company he worked for with the best record of successful hiring (defined as keeping new employees longer than 2 years) succeeded 50% of the time. He claimed they were the best because they identified and removed the unsuccessful quickly, usually within 90 days. So large companies with full blown professional HR staffs are unsuccessful half the time in making good hires. Our conclusion is that the scientific method is the best in finding good help in small companies, i.e. theorize, test and measure the results. We’ve tried a variety of formal tests and worked hard to uncover who the successful will be by honing our interviewing skills. But we reflected that it’s best to do all those things, then hire on a trial basis only. The successful hires will reveal themselves, early, say in the first 3 weeks. Others will take longer but on reflection, we believe that you will know everything you need to know within 30 days. But even when you know, making a change is enormously difficult for the small company. Everyone is already fully occupied in performing the work of the company, not dealing with personnel problems and nobody wants to keep dealing with them. But it’s best to move on quickly when someone proves they will never work out and move on to finding the next candidate. I’d like to say we’ve been more successful than my friend’s low bar of 50% but like every entrepreneur we know, we haven’t solved the problem either, even after 25 years. And with all the good employment news it’s about to get much tougher for small companies to hire well. June's Feature ""Positive talk" has been popularized in professional sports, especially golf for the past 20 years. There are astounding anecdotes especially in sports. Sports psychology is an obviously very good experimental laboratory because of the tremendous rewards and penalties and the immediacy of the feedback from implementation of the theory. The current advice to succeed at going from negative talk to positive talk is following routines similar to physical training, always a challenge." - Trevor Morgan, CEO & Founder, Prairie Business Credit What Others Are Saying About Us "We have never seen such growth in all the past 35 years we've been in business. On our way to a banner year! We appreciate all of Prairie Business Credit's support in the past years to help us get here!" - President of Welding Company 25 Years Has Taught Us... After being in business for 25 years, financing over 500 companies, graduating 70% of them to be bankable clients, we have learned a few things along the way.

A business should focus on the things they do best. Most times, their expertise lies solely with the product or service they provide. For all the other things that a business owner has to get done, find qualified professionals to do it for you. A business owner's time is far too valuable to spend on things not core to their business or expertise. Who are Good Candidates for Factoring?

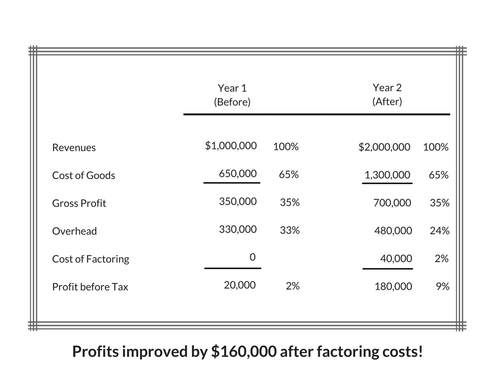

May's Feature What Others Are Saying About Us "We have never seen such growth in all the past 35 years we've been in business. On our way to a banner year! We appreciate all of Prairie Business Credit's support in the past years to help us get here!" - President of Welding Company 25 Years Has Taught Us... After being in business for 25 years, financing over 500 companies, graduating 70% of them to be bankable clients, we have learned a few things along the way. When you as a business owner enter into a contract with a customer, make sure you understand everything it entails. Before you agree to bind yourself into any agreement, you must know what you are agreeing to do. Can you live up to your potential customer's expectations? Do you understand what your customer expects of you? Too many times we have been the ones explaining some potentially devastating provisions in vendor agreements that our clients have agreed to. Provisions they never would have agreed to if they had read the entire agreement. The time to negotiate those things is before you sign. Is Prairie Business Credit Expensive? How Much Do They Charge? The fee varies with the amount of time it takes to collect the receivables. The average fee is often in the range of 2%-5% of the face amount of the invoice. Factoring costs are tied only to sales. Will the benefits of factoring outweigh the cost? This is the most critical consideration. The cost of capital should be viewed as an investment which will advance the business, just as is a new piece of equipment is an investment. You shouldn't spend money on a piece of equipment unless it increases sales and profit or reduces costs. The cost of acquiring cash through factoring should be weighed in the same way. The immediate and ongoing availability of cash must help to increase sales and profits. The following exhibit summarizes the financial impact on an actual company that uses factoring to fund its sales growths. This company began with $1 million in total sales. By factoring, they were able to double sales to $2 million in the following year. They paid $40,000 in factoring costs, and increase their profit nine times, to $180,000. The factoring cost is 4% and $1 million of receivables were factored in the second year. April's Feature What Others Are Saying About Us "We have never seen such growth in all the past 35 years we've been in business. On our way to a banner year! We appreciate all of Prairie Business Credit's support in the past years to help us get here!" - President of Welding Company 25 Years Has Taught Us... After being in business for 25 years, financing over 500 companies, graduating 70% of them to be bankable clients, we have learned a few things along the way.

A shipment isn't a sale. New opportunitues are great, but make sure you know who your customers are. Do they have the wherewithal to pay for your product? Do you understand the terms on which they have agreed to buy from you? In the Age of the Internet, We Still Do Business Face to Face Prairie Business Credit has been meeting with entrepreneurs face to face for 25 years. We get to know our clients to develop a trusting relationship and do our best to understand their cash flow needs. Whether our clients are in Hong Kong, Oshkosh or South Carolina, meeting with our clients face to face is a crucial element to a successful partnership. When you are trying to provide an entrepreneur the cash they need to grow, communicating over the internet or over the phone just doesn't work. March's Feature What Others Are Saying About Us "From my first meeting with Prairie Business Credit, they have gone out of their way to meet with my executive team to gain a better understanding of our current and future lending needs. They have since come back with a very attractive, flexible, comprehensive and competitive contract that puts us in a stronger position to grow and go after the doors that God continues to open. I would highly recommend Prairie Business Credit!" - President, Lighting Company 25 Years Has Taught Us... After being in business for 25 years, financing over 500 companies, graduating 70% of them to be bankable clients, we have learned a few things along the way.

Never be afraid to admit that you don't understand. Simply take the time to admit what you don't know and learn. Everyone is better off for it. A Leap of Faith; Our Number One Goal is that Our Clients Leave Us 25 years ago Prairie Business Credit started doing business like every other factor. Soon we changed the way we do business dramatically. Prairie Business Credit's number one goal is to graduate our clients to traditional banking or self funding. The leap of faith was choosing a business plan that makes the client so successful they no longer need us. Choosing our client's success as our primary goal was simply the right thing to do. We strive to graduate our clients to traditional banking and allow them to leave Prairie Business Credit, penalty free. We are absolutely confident that there will always be not yet bankable entrepreneurs who need money to seize fleeting opportunities. February's Feature What Others Are Saying About Us "A special thanks to all of you who have been so welcoming to our new Vice President, Dave Krause. We are pleased to share this letter from one of our newest Wisconsin clients." - Trevor and Dylan Morgan February 23, 2018 To whom it may concern, I am the owner of a LED lighting consulting firm. I rely on a secondary lender to finance many orders for our clientele and I have recently made the decision to move from a nationwide lender to Prairie Business Credit. Dave Krause was the first member of Prairie Business Credit that I met and after my first meeting I knew that this was a man I could trust and wanted to do business with. His character, personality and honesty won me and my executive team over from day one. He has also invested a lot of time and energy to get to know me and my team personally as well as our lending needs. Dave has then gone above and beyond to help us find the best lending options and has also gone out of his way to refer our services to his circle of influence. I was then introduced to Trevor, Dylan and Ron from Prairie Business Credit and was pleased to find out that Dave is a true reflection of who they are and what Prairie Business Credit stands for. The personal and professional attention that we have been shown is second to no other lender that I have dealt with over the past 25 years of business. I am pleased to say that Prairie Business Credit is truly there to help find the best lending solutions for your needs while being treated fairly, respectfully and honestly. If a secondary lender is a solution to your lending needs, then I cannot recommend strongly enough that you consider partnering with Prairie Business Credit. God bless, - President, Lighting Company in Wisconsin 25 Years Has Taught Us... After being in business for 25 years, financing over 500 companies, graduating 70% of them to be bankable clients, we have learned a few things along the way.

Prospects often withhold information that they think is embarrassing which it never is. It's just information; clues to the success puzzle. Our Second Client Defrauded Us; How it Changed the Way We Do Business and How it Separates Us From Our Competitors Any entrepreneur can tell you their struggles of growing their business. 25 years ago, Prairie Business Credit's second client defrauded them for $35,000. Trevor Morgan knew the deal had red flags but was too worried about turning the deal down. He needed the income since he was only in his third month in business. Most young entrepreneurs can relate to this because they feel pressure to take the sale to grow their business. This mistake was a huge turning point for Prairie Business Credit because Morgan realized he spent more time trying to collect on the bad deal instead of turning it down and looking for a better deal. Prairie Business Credit began to differentiate themselves from other factorers by educating and training their client on best credit practices so these mistakes do not happen. Don't get caught selling to a company without the means to repay you. Prairie Business Credit will help you determine who is credit worthy and who is not. January's Feature What Others Are Saying About Us "We were helping to finance an acquisition for my customer. My customer needed a quick turnaround so our bank called Prairie Business Credit to provide the working capital. This was critical to the acquisition so the customer could hit the ground running, keeping suppliers paid and raw materials readily available. If we didn't have Prairie Business Credit, my customer would have needed to raise a lot more capital. Prairie Business Credit was very responsive and moved quickly to get the deal done. Our bank has had a long-term relationship with Prairie Business Credit for over 20 years. They are a trusted and known resource to our bank because they are very bright, responsive and they have the ability to move quickly to fund a deal." - Vice President Business Banking 25 Years Has Taught Us... After being in business for 25 years, financing over 500 companies, graduating 70% of them to be bankable clients, we have learned a few things along the way. Prairie's advice to new entrepreneurs, is to find a mentor for advice. This person should be an entrepreneur who you respect, has had both success and failings. They should be someone you can trust that will always give their honest opinion, even when it isn't what you want to hear. It is critical that this mentor be willing to hold you to account, because as a new entrepreneur, you need to be held accountable if you hope to achieve your goals. Make No Little Plans The famous Chicago architect, Daniel Burnham told us to “make no little plans; they have no magic to stir men’s blood.” Quite inspiring. However, the biggest plans don’t always start out big in reality. For an entrepreneur, the opportunities that may seem little to others are not little to them. Prairie Business Credit has been helping small businesses for the past 25 years take advantage of those opportunities, no matter how small. Sometimes it is harder for small businesses to access credit from traditional sources. That doesn’t mean that working capital isn’t available when their big break comes, no matter how little it is. Prairie is ready to provide working capital by financing accounts receivable for companies with as little as $10K per month in sales. Let Prairie help your customer realize the great plans that they have made by turning that small order into real growth. December's Feature "Entrepreneurs’ opportunities come at all different ages and locations. I’ve had the pleasure of working with companies at well appointed offices and others just sprouting up in a home office in the basement." - Dylan Morgan, Executive Vice President What Others Are Saying About Us "We were helping to finance an acquisition for my customer. My customer needed a quick turnaround, so our bank called Prairie Business Credit to provide the working capital. This was critical to the acquisition so the customer could hit the ground running, keeping suppliers paid and raw materials readily available.

If we didn't have Prairie Business Credit, my customer would have needed to raise a lot more capital. Prairie Business Credit was very responsive and moved quickly to get the deal done. Our bank has had a long- term relationship with Prairie Business Credit for over 20 years. They are a trusted and known resource to our bank because they are very bright, responsive and they have the ability to move quickly to fund a deal." - Vice President Business Banking There are two ways we get you the cash you need to keep growing your business:

Purchase Order Financing P.O. financing is perfect when you get a big order but don’t have the resources to fill it. You need the work and don’t want to turn it down, but traditional financing won't work and time is running out. You bring us the purchase orders, and we’ll provide the backing to keep your business moving forward. Factoring Factoring is a way of turning current receivables into immediate cash. We purchase your outstanding receivables, so you don't have to wait for two months to have money you need now, or worry about the collection and administrative hassle. You can fill those orders and grow your business. When you need money and traditional financing won't work, this is your best way to get operating cash without giving up control. If you have a big opportunity to grow your business, don't turn it down - get some operating cash from Prairie Business Credit, and keep your business moving forward. November's Feature What Others Are Saying About Us "We were helping to finance an acquisition for my customer. My customer needed a quick turnaround, so our bank called Prairie Business Credit to provide the working capital. This was critical to the acquisition so the customer could hit the ground running, keeping suppliers paid and raw materials readily available. If we didn't have Prairie Business Credit, my customer would have needed to raise a lot more capital. Prairie Business Credit was very responsive and moved quickly to get the deal done. Our bank has had a long- term relationship with Prairie Business Credit for over 20 years. They are a trusted and known resource to our bank because they are very bright, responsive and they have the ability to move quickly to fund a deal." - Vice President Business Banking |

Topics

Purchase Order Financing and Factoring How Does Factoring Work? Calculating the Benefits of Factoring When Should You Consider Factoring? Factoring in Five Simple Steps 13 Week Cash Flow Forecast Businesses Need to Protect Their Cash Flow During the Pandemic The Cash Gap Our Second Client Defrauded Us - How it Changed the Way We Do Business Is Prairie Business Credit Expensive? How Much Do They Charge? Top Ten Reasons to Factor You Need Cash for Growth Who are Good Candidates for Factoring? Our Number One Goal is that Our Clients Leave Us A Bridge to Where? In the Age of the Internet, We Still Do Business Face to Face Credit Checks Cash Management Two Fundamental Principles When Giving Your Customers Payment Terms Team Up with a Factor To Earn Lifelong Business Customers Make No Little Plans Prairie Business Credit Promotes Morgan Prairie Business Credit Promotes Diversey Categories |

RSS Feed

RSS Feed