|

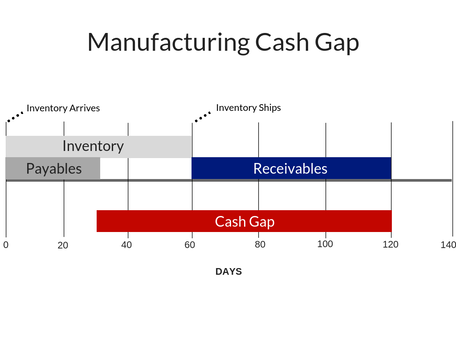

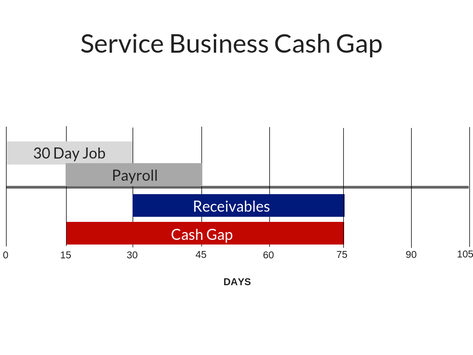

Factoring and the "Cash Gap" Cash flow makes or breaks a company, regardless of how successful that company may appear to be. Understanding the "cash gap" is key to understanding cash flow issues. The cash gap is the number of days between a company's payment for materials or services and its receipts from sales. If a company is to grow, it must bridge the cash gap. If not, a company experiencing rapid growth could find itself on the verge of bankruptcy, simply because cash flow exceeds inflow. Profitable companies can and do go out of business because they didn't close the cash gap. December's Feature “Entrepreneurship comes to people in many ways for many reasons. Carefully planning and understanding the risks associated with it is an important start towards success." - Dylan Morgan, Executive Vice President, Prairie Business Credit What Others Are Saying About Us "Our company had expenses to pay before our customer would pay us. We were looking for alternative financing. Prairie Business Credit was highly recommended from our bankers. Prairie Business Credit completed what they promised and helped us grow. They are very supportive partners."

- President of Disaster Recovery Company

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Topics

Purchase Order Financing and Factoring How Does Factoring Work? Calculating the Benefits of Factoring When Should You Consider Factoring? Factoring in Five Simple Steps 13 Week Cash Flow Forecast Businesses Need to Protect Their Cash Flow During the Pandemic The Cash Gap Our Second Client Defrauded Us - How it Changed the Way We Do Business Is Prairie Business Credit Expensive? How Much Do They Charge? Top Ten Reasons to Factor You Need Cash for Growth Who are Good Candidates for Factoring? Our Number One Goal is that Our Clients Leave Us A Bridge to Where? In the Age of the Internet, We Still Do Business Face to Face Credit Checks Cash Management Two Fundamental Principles When Giving Your Customers Payment Terms Team Up with a Factor To Earn Lifelong Business Customers Make No Little Plans Prairie Business Credit Promotes Morgan Prairie Business Credit Promotes Diversey Categories |

RSS Feed

RSS Feed