June's Feature "Leading with the straight forward truth is the best. If you can’t find the money without that, maybe you just aren’t ready. Great ideas always find the money to make it work."

- Dylan Morgan, Executive Vice President, Prairie Business Credit

0 Comments

Dylan Morgan, Prairie EVP, right, and Prairie CEO Trevor Morgan, center, discuss growth plans with Eric Withaar of Premium Custom Products. If you are a small business banker tasked with bringing in new business, find a factor to partner with. Customer loyalty in any business is built by satisfying prospects’ strongest needs when they need it most, and an independent factor can help fill that temporary need until the prospect is bankable. Nearly every young business is starved for cash, and most are unlikely to qualify for bank financing. Factoring is the purchase of the client’s accounts receivable at a discount; factors are the companies that complete factoring transactions. Factoring gets cash into the budding entrepreneur’s hands immediately upon sale, which can mean everything to the success of the business. It’s one of the oldest known forms of money lending, with records dating back 3,700 years. When I was prospecting for small commercial customers as a bank trainee in 1974, I learned an invaluable lesson about what can be gained by timely satisfaction of a prospect’s borrowing needs. I learned the lesson when calling on Frank, the friendly founder and owner of a small screw machine shop. I managed to get the appointment only because Frank was heading his golf club’s membership committee, and young commercial bankers were prime targets. On that day, though, neither of us was buying from the other. I had to politely decline joining the golf club – though I did join three years later – because that type of bank perk wasn’t offered to newbies like me. Frank wasn’t buying from me, either. Instead he told me the story of how my bank’s best local competitor had walked into his office 20 years earlier – the day Frank opened his doors – and put together a loan package that Frank desperately needed to seize a profitable sale. Because of that, he said there was absolutely nothing my bank could offer that would get him to move, no matter how our services stacked up, or whether I joined the golf club. Frank’s experience encapsulated a universal truth about creating a competitive advantage by satisfying a critical need at the right moment. Find the referred prospects with critical cash needs and a way to satisfy them, and they’ll stay at the referring bank forever. Factors have no magic credit knowledge that enables them to make loans a bank cannot. They simply are able to lend to difficult credits by verifying every invoice they advance on and by taking absolute dominion of collections. Factoring is more expensive than bank loans, because a factor’s operating expenses are exponentially higher, due to attention paid to the client’s administrative detail. That intense monitoring also imposes good credit, billing and collection habits on the borrower. So when the performance and balance sheets of a factor’s clients pass muster with the bank’s credit standards, the bank can be reasonably certain that the prospect’s administration and reporting abilities are in good order. Most factoring operations are not bank-affiliated, so they do not compete with the bank for services. Some factors specialize in industries such as trucking, where the customer will remain a borrower of the factor. Others act as bridge lenders, which pertain to the banking community, because they fill a need for sizable working capital when the borrower’s balance sheet won’t satisfy a bank’s credit requirements. When a factor concentrates on companies with strong gross margins and large immediate growth opportunities, its clients generally level off in their growth, collect their profits, and build their balance sheets well enough to satisfy a bank lender in 12 to 18 months. Graduation rates of factoring clients vary radically, depending on the factor’s approach, so their graduation rate can be a good indicator of your chances of getting your referral back. If you are a business banker with a need to get a competitive leg up and establish lifelong customers, consider partnering with a factor. Factoring is an effective tool to lend to nearly unbankable companies, and it can increase your chances of banking your “Forever Frank” customers. - Trevor Morgan, Founder & CEO, Prairie Business Credit This article was featured in the Hoosier Banker Magazine May/June 2019 issue. May's Feature "This article has a lot of great lessons for small business owners. I most appreciated the call to learn to apologize. This seems to apply to so many things both professionally and personally." - Dylan Morgan, Executive Vice President, Prairie Business Credit What Others Are Saying About Us "We were helping to finance an acquisition for my customer. My customer needed a quick turnaround, so our bank called Prairie Business Credit to provide the working capital. This was critical to the acquisition so the customer could hit the ground running, keeping suppliers paid and raw materials readily available.

If we didn't have Prairie Business Credit, my customer would have needed to raise a lot more capital. Prairie Business Credit was very responsive and moved quickly to get the deal done. Our bank has had a long- term relationship with Prairie Business Credit for over 20 years. They are a trusted and known resource to our bank because they are very bright, responsive and they have the ability to move quickly to fund a deal." - Vice President Business Banking 1. OUR SUCCESS IS DEFINED BY OUR CLIENT'S SUCCESS. Prairie Business Credit serves both as a trusted financial resource and consultant to entrepreneurs dedicated to building their businesses and insuring their success. For over 25 years, Prairie has helped nearly 70% of our clients progress to bank or self-financing. Prairie has served clients from coast to coast with the funding and advice they need to stabilize, succeed and grow. 2. WE ARE A FAMILY RUN COMPANY. Trevor Morgan started Prairie Business Credit in 1993 after 20 years of experience with regional banks and private finance companies. Dylan Morgan, Trevor's son, joined Prairie Business Credit in 2003 to continue in his father's footsteps by learning the family business. We consider all of our employees part of the Prairie Business Credit family. Being a family run company helps us connect with our entrepreneurial clients who are often family run businesses. . 3. WE ARE A PRIVATE COMPANY. Since we are a private company, we are able to give you personal attention unlike other large financial institutions. We evaluate your cash flow needs quickly with our tightly run credit process. April's Feature "This is a great story about the journey of a pair of entrepreneurs. The education and sacrifice most make to achieve success is on display here." - Dylan Morgan, Executive Vice President, Prairie Business Credit What Others Are Saying About Us "The experience I had with Prairie was nothing but positive. I owned a school bus company some years ago and was in a position with a very slow paying customer. Prairie was easy to work with, they understood my needs and the transactions were simple. I would recommend them to my business clients and I have already done so. I really appreciate the personal touch."

- Previous Client and Current Referral Source www.prairiebiz.com 1. Big Growth Without Giving Up Equity When you finally get that sale that can take your company to the next level, you don't need to take on a partner. Get the working capital you need by factoring. 2. Better Cash Flow Management Do you find yourself anxiously awaiting at the mailbox because you need that check in the mail? By factoring your receivable, you get cash when you make a sale. Prairie Business Credit will wait for the sale and smooth out your cash flow. 3. Reduce Bad Debt Don't get caught selling to a company without the means to repay you. Prairie Business Credit will help you determine who is credit worthy and who is not. 4. Improve Credit Rating Paying your vendors on time will help you earn a better business credit rating. It will also instill confidence in your vendors, so they will offer you better credit terms. 5. Take Advantage of Supplier Discounts If you paid your vendors faster, would they give you a discount? With the cash available from factoring, you may be able to negotiate better prices from your suppliers. 6. Capture New Sales Opportunities Have you ever walked away from a sale because you thought you didn't have the cash flow to support it? Realize those profits and take on those new sales with improved cash flow through factoring. 7. Slow Turning Receivables Sometimes receivables aren't paid because of clerical errors on your end. Let Prairie manage the receivables process and remove all the hurdles between you and faster paying invoices. 8. Too New for the Bank Many times banks won't lend to newer businesses. That doesn't mean your newer business doesn't need working capital. By factoring your accounts receivable, even startup companies can get the working capital they need from Prairie. 9. High Customer Concentration on Receivables Sometimes that great new opportunity leads to a customer concentration. Many lenders and factors shy away from that situation. Prairie can still get you the working capital you need, even if your sales are concentrated. 10. Cost Savings on Collections and Administration You can leverage Prairie's expertise and efficient processes to focus your workforce on other tasks in your business. Instead of hiring more clerical staff to manage your growing sales, let Prairie take that on for you. March's Feature What Others Are Saying About Us "We were helping to finance an acquisition for my customer. My customer needed a quick turnaround so our bank called Prairie Business Credit to provide the working capital. This was critical to the acquisition so the customer could hit the ground running, keeping suppliers paid and raw materials readily available. If we didn't have Prairie Business Credit, my customer would have needed to raise a lot more capital. Prairie Business Credit was very responsive and moved quickly to get the deal done.

Our bank has had a long-term relationship with Prairie Business Credit for over 20 years. They are a trusted and known resource to our bank because they are very bright, responsive and they have the ability to move quickly to fund a deal." - Vice President Business Banking www.prairiebiz.com "Whether this prediction will come true or not, it is a good reminder to all business owners to remember two fundamental principles when giving your customers payment terms: 1. Does your customer have the wherewithal to pay? 2. Do they have the desire to pay? You should always be able to answer both of those questions when extending payment terms. As lenders, these are two questions we are always trying to answer when working with our clients. It is also important for all lenders to pay attention to which customers their clients have large concentrations with and how they will be impacted by the economic tide." - Ron Diversey, Senior Vice President and Chief Credit and Operations Officer, Prairie Business Credit What Others Are Saying About Us "We were helping to finance an acquisition for my customer. My customer needed a quick turnaround so our bank called Prairie Business Credit to provide the working capital. This was critical to the acquisition so the customer could hit the ground running, keeping suppliers paid and raw materials readily available. If we didn't have Prairie Business Credit, my customer would have needed to raise a lot more capital. Prairie Business Credit was very responsive and moved quickly to get the deal done.

Our bank has had a long-term relationship with Prairie Business Credit for over 20 years. They are a trusted and known resource to our bank because they are very bright, responsive and they have the ability to move quickly to fund a deal." - Vice President Business Banking Prairie Business Credit Expands Into Indiana Prairie Business Credit is pleased to announce their expansion into Indiana. In order to serve the Indiana market and meet the needs of Indiana entrepreneurs who are participating in Indiana's unprecedented growth, Prairie Business Credit opened an office in Indianapolis. Our financial services will help Indiana bankers grow their customer base, bridging between start up and being bank loan qualified. "We are excited about the opportunities in Indiana for our potential clients who can accelerate their growth with our financial and management assistance," said Prairie CEO Trevor Morgan. Prairie Business Credit's Indiana address is 3815 River Crossing Parkway, Suite 100, Indianapolis, IN 46240. Trevor Morgan and his team can be reached at their new phone number: 317- 668-0700. January's Feature "My key takeaway here is the quote "So the bottom line is differentiation". This is an entrepreneur who understands that in order to get customers to pay you for your product or service, you must be able to show value. Otherwise, you are simply a commodity." - Dylan Morgan, Executive Vice President, Prairie Business Credit What Others Are Saying About Us "Our company had expenses to pay before our customer would pay us. We were looking for alternative financing. Prairie Business Credit was highly recommended from our bankers. Prairie Business Credit completed what they promised and helped us grow. They are very supportive partners."

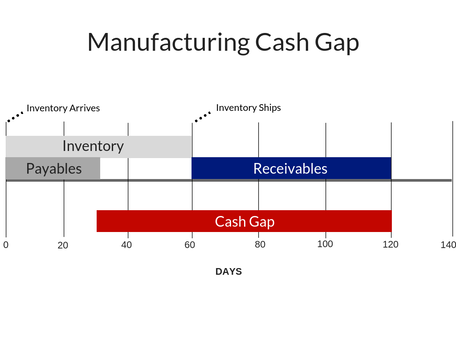

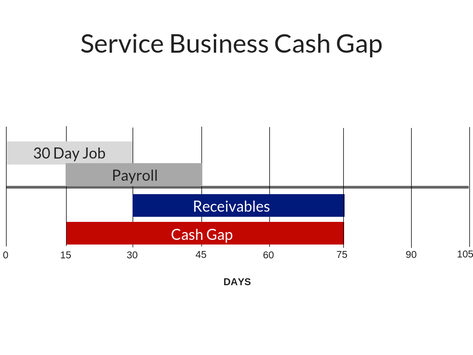

- President of Disaster Recovery Company Factoring and the "Cash Gap" Cash flow makes or breaks a company, regardless of how successful that company may appear to be. Understanding the "cash gap" is key to understanding cash flow issues. The cash gap is the number of days between a company's payment for materials or services and its receipts from sales. If a company is to grow, it must bridge the cash gap. If not, a company experiencing rapid growth could find itself on the verge of bankruptcy, simply because cash flow exceeds inflow. Profitable companies can and do go out of business because they didn't close the cash gap. December's Feature “Entrepreneurship comes to people in many ways for many reasons. Carefully planning and understanding the risks associated with it is an important start towards success." - Dylan Morgan, Executive Vice President, Prairie Business Credit What Others Are Saying About Us "Our company had expenses to pay before our customer would pay us. We were looking for alternative financing. Prairie Business Credit was highly recommended from our bankers. Prairie Business Credit completed what they promised and helped us grow. They are very supportive partners."

- President of Disaster Recovery Company Cash Management Merriam -Webster defines opportunity cost as the "cost of making an investment that is the difference between the return on one investment and the return on an alternative." By carrying high aging receivables, your actual return on investment is significantly lower than your return on investment would be if you were able to reinvest the cash when it came in sooner. The opportunity cost of lost potential sales is the truly damaging property of long outstanding accounts receivable. The effect of opportunity cost can easily be seen in the following example of a previous client of ours who was involved in the heavy machinery rental business. When the company lent its equipment to slow paying customers, the equipment would sit idle at job sites while quick paying customers went without equipment because it was already loaned out. Had our client sold first to those customers who would pay in quick terms, they would be able to turn their cash around faster. This would allow them to reinvest in more machinery to facilitate those who pay in quick terms, further increasing company sales. Instead of having the company's cash sit idle, cash stream and growth would increase. November's Feature “An equity investment of any kind can often seem like the easy way to go at first. However, giving up a portion of your company is a very permanent thing. Some situations truly call for an equity partner to come in. However, in the case where working capital is needed, Prairie’s factoring or purchase order financing programs should be considered.” - Dylan Morgan, Executive Vice President What Others Are Saying About Us "Our company had expenses to pay before our customer would pay us. We were looking for alternative financing. Prairie Business Credit was highly recommended from our bankers. Prairie Business Credit completed what they promised and helped us grow. They are very supportive partners."

- President of Disaster Recovery Company Credit Checks While you may not want to take the time to perform a credit inquiry into a company over a small, one-time invoice, taking an active role in assessing potential client's creditworthiness is a critical goal of a successful company. It may be tempting to accept that large order on good faith because you feel asking for credit references may hinder closing the deal, but it is a risk a small and growing business can not afford to take. Credit references are common practice in industry and commerce, and asking for one does not imply a lack of trust. It is simply the prudent thing to do before accepting large orders from unknown customers. Recently, a customer of ours accepted a deal with a company for approximately $30,000 in invoices to be billed in three stages. When the first invoice arrived at Prairie Business Credit, no credit work had been done on the customer. As part of Prairie working guidelines, an invoice of this size for the company in question was automatically subject to a bank and trade inquiry. This simple and standard form completed by Prairie's underwriting department uncovered that not only did the company have poor payment history, they currently did not have enough money to support the project. While our customer was out the value of the first invoice, approximately $12,000, they were saved from a loss of nearly $30,000 by simple bank and trade references. Although Prairie can not provide specific credit information on your clients, we are able to assist you in credit assessments and provide a recommendation to you as to what a credit limit we would assign them. This service is already included in the fee structure. Getting in the habit of requesting bank and trade references on new deals is a practice that can help prevent financial devastation. October's Feature "This article talks about how the entrepreneurial road is sometimes a lonely one. Running a small business requires the entire team to be focused, and shielding that team from the rigamarole and the ups and downs can be necessary." Dylan Morgan, Executive Vice President, Prairie Business Credit What Others Are Saying About Us "We have never seen such growth in all the past 35 years we've been in business. On our way to a banner year! We appreciate all of Prairie Business Credit's support in the past years to help us get here!"

- President of Welding Company When Should You Consider Factoring? When lack of cash keeps you from making the next sale, factoring may be a solution. When the benefits of factoring (including immediate access to cash, and the ability to continue production, make payroll, pay taxes, and/or take advantage of vendor discounts) outweigh the costs of factoring, then factoring should be considered. How to tell:

September's Feature "This article gives an excellent perspective of why a great operating company may not be a great innovator anymore. The great operators of the world certainly do need to have innovative products and processes, but acquiring them may end up being the best path for them." Dylan Morgan, Executive Vice President, Prairie Business Credit What Others Are Saying About Us "Prairie Business Credit quickly assessed an existing borrower's financing needs, and they refinanced us out of that difficult credit. They closed what they proposed, and we've added them to our bank's possible refinance lenders in the Chicagoland marketplace." - Bank C&I Workout Leader 25 Years Has Taught Us... After being in business for 25 years, financing over 500 companies, graduating 70% of them to be bankable clients, we have learned a few things along the way.

Honestly assessing your product and service is what your customers do. Know what they think. An ongoing and built in mistake most entrepreneurs make, especially those with a close knit team, can and often do make is to reassure themselves that they are meeting their customer's/client's needs, without really knowing if that's true. All the best companies we've dealt with in the past few years, survey their buyers constantly. So should you. We're just starting. The answers can be both uplifting and a cold splash of reality. The customer is paying for your product or service so they are really the only opinion that matters. |

Topics

Purchase Order Financing and Factoring How Does Factoring Work? Calculating the Benefits of Factoring When Should You Consider Factoring? Factoring in Five Simple Steps 13 Week Cash Flow Forecast Businesses Need to Protect Their Cash Flow During the Pandemic The Cash Gap Our Second Client Defrauded Us - How it Changed the Way We Do Business Is Prairie Business Credit Expensive? How Much Do They Charge? Top Ten Reasons to Factor You Need Cash for Growth Who are Good Candidates for Factoring? Our Number One Goal is that Our Clients Leave Us A Bridge to Where? In the Age of the Internet, We Still Do Business Face to Face Credit Checks Cash Management Two Fundamental Principles When Giving Your Customers Payment Terms Team Up with a Factor To Earn Lifelong Business Customers Make No Little Plans Prairie Business Credit Promotes Morgan Prairie Business Credit Promotes Diversey Categories |

RSS Feed

RSS Feed