|

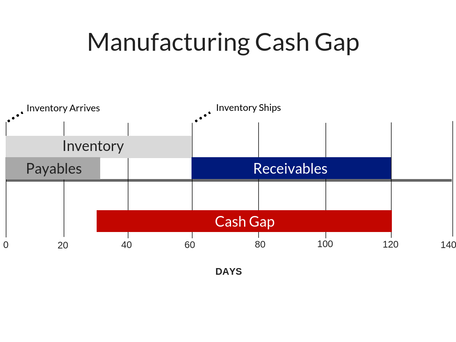

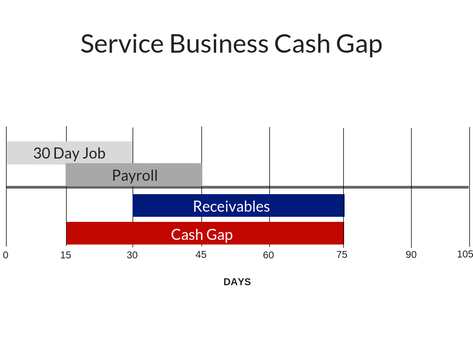

July 2020, Newsletter Businesses Need to Protect Their Cash Flow During the Pandemic In order to survive as an entrepreneur, optimism is necessary. As we see in the article below, this optimism is still strong in our entrepreneurs, despite the COVID-19 pandemic. However, blind optimism without the proper preparation is more akin to gambling than running a business. So, what happens to a business's cash after a period of lower revenue, and sales start surging? If a company sells to customers and offers terms, as revenues surge, a business could face a severe cash shortfall. In times with steady revenue, a business should expect to collect a consistent amount of cash each week that would equate to the amount of sales they had 6 weeks ago, assuming their customers pay at 6 weeks on average. When a company goes through a sales downturn, it stands to reason that 6 weeks after that, the cash intake will be equivalent to the lower level of sales. As we see in the Manufacturing Cash Gap and Service Business Cash Gap graphics below, the higher inventory and payroll cash needs come much sooner than the increased accounts receivable collections. So as sales grow, cash needs increase and the company is left with less cash coming in the door. This can be a recipe for disaster. A company with well-structured debt should have a line of credit in place for times like these, but what about the companies that don’t or for the company that used that line of credit to get through the shutdown? Factoring could be a great tool for helping them take advantage of surging sales, because factoring allows a company to receive cash when their product or service is delivered instead of waiting that critical 6 weeks. What Others Are Saying About Us “After the downturn, our bank relationship changed. We were getting back on our feet and making payments but we needed cash to meet our customers’ needs. We looked at a lot of lenders. Prairie Business Credit understood manufacturing and they understood our needs. They came up with flexible solutions that helped us with cash flow so we could take orders, even months out. We didn’t lose orders and they helped us manage receivables so we stayed on top of past due accounts. Prairie Business Credit supported us until we could get an SBA loan with a bank."

- Former Client

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Topics

Purchase Order Financing and Factoring How Does Factoring Work? Calculating the Benefits of Factoring When Should You Consider Factoring? Factoring in Five Simple Steps 13 Week Cash Flow Forecast Businesses Need to Protect Their Cash Flow During the Pandemic The Cash Gap Our Second Client Defrauded Us - How it Changed the Way We Do Business Is Prairie Business Credit Expensive? How Much Do They Charge? Top Ten Reasons to Factor You Need Cash for Growth Who are Good Candidates for Factoring? Our Number One Goal is that Our Clients Leave Us A Bridge to Where? In the Age of the Internet, We Still Do Business Face to Face Credit Checks Cash Management Two Fundamental Principles When Giving Your Customers Payment Terms Team Up with a Factor To Earn Lifelong Business Customers Make No Little Plans Prairie Business Credit Promotes Morgan Prairie Business Credit Promotes Diversey Categories |

RSS Feed

RSS Feed