|

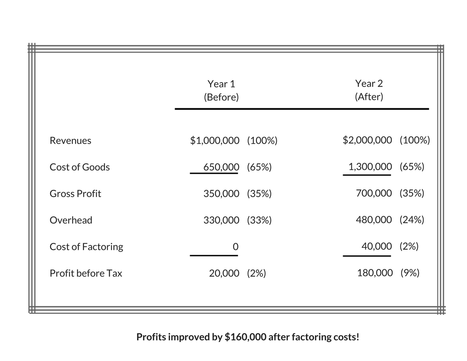

CALCULATING THE BENEFITS OF FACTORING Will the benefits of factoring outweigh the cost? This is the most critical consideration. The cost of capital should be viewed as an investment which will advance the business, just as is a new piece of equipment. You would not spend money on a piece of equipment unless you were convinced that it would increase sales and profit or reduce costs. The cost of acquiring cash through factoring should be weighed in the same way. The immediate and ongoing availability of cash must help to increase sales and profit. The following exhibit summarizes the financial impact on an actual company that uses factoring to fund its sales growth. This company began with $1 million in total sales. By factoring, they were able to double sales to $2 million in the following year. They paid $40,000 in factoring costs, and increased their profit nine times, to $180,000. The factoring cost is 4% and $1 million of receivables were factored in the second year. August's Features What Others Are Saying About Us "We were helping to finance an acquisition for my customer. My customer needed a quick turnaround, so our bank called Prairie Business Credit to provide the working capital. This was critical to the acquisition so the customer could hit the ground running, keeping suppliers paid and raw materials readily available.

If we didn't have Prairie Business Credit, my customer would have needed to raise a lot more capital. Prairie Business Credit was very responsive and moved quickly to get the deal done. Our bank has had a long- term relationship with Prairie Business Credit for over 20 years. They are a trusted and known resource to our bank because they are very bright, responsive and they have the ability to move quickly to fund a deal." - Vice President Business Banking

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Topics

Purchase Order Financing and Factoring How Does Factoring Work? Calculating the Benefits of Factoring When Should You Consider Factoring? Factoring in Five Simple Steps 13 Week Cash Flow Forecast Businesses Need to Protect Their Cash Flow During the Pandemic The Cash Gap Our Second Client Defrauded Us - How it Changed the Way We Do Business Is Prairie Business Credit Expensive? How Much Do They Charge? Top Ten Reasons to Factor You Need Cash for Growth Who are Good Candidates for Factoring? Our Number One Goal is that Our Clients Leave Us A Bridge to Where? In the Age of the Internet, We Still Do Business Face to Face Credit Checks Cash Management Two Fundamental Principles When Giving Your Customers Payment Terms Team Up with a Factor To Earn Lifelong Business Customers Make No Little Plans Prairie Business Credit Promotes Morgan Prairie Business Credit Promotes Diversey Categories |

RSS Feed

RSS Feed