|

Maybe it’s because a large order came in. Maybe your biggest customers are late on their invoices. Maybe it’s growing fast, but your business hasn’t quite cleared the bar for bank financing. Whatever the reason, you’re feeling the squeeze and could use an influx of cash, but you’re not sure about your financing options.

If so, it’s time to take a closer look at invoice factoring—and to debunk common myths about this financing option. What is Invoice Factoring? Invoice factoring is a financing method in which a business sells its accounts receivable to a factoring company. The factoring company provides an immediate cash advance, then collects on these unpaid invoices from the business’s customers—and finally pays the business the balance of the invoice minus a service fee. Invoice factoring can benefit businesses of any size, at any stage of maturity, from start-up to established companies seeking an alternative to bank financing. Misperceptions about invoice factoring are common, though, so let’s break them down. Myth #1: Invoice factoring is only for companies in trouble. Unfortunately, many business owners either don’t understand invoice factoring or see it as a sign their business is failing. Yes, invoice factoring can be an option when a business is rebuilding credit or facing difficulties, but it’s not the only condition under which a business might factor its invoices. New companies may not yet qualify for bank financing, given the rigors of the process, but can access working capital through factoring invoices. Established businesses can also benefit from an injection of working capital to cover a temporary cash crunch, land a new business opportunity, or make an acquisition while fulfilling payroll and vendor commitments. Myth #2: Traditional financing is better. Mostly true. Bank financing and lines of credit are certainly the mainstay for many businesses, but they aren’t the only option. Sometimes they aren’t even an option, or if they are, they don’t provide enough funding for your growth. Financing options outside the bank that can help your business meet its commitments and grow deserve consideration, whether your company is new, facing challenges, or simply in need of immediate access to working capital. Myth #3: You'll give up control of your company. Many owners are reluctant to give up any control over their decisions and operations, and this is understandable. A factoring company may decline to purchase invoices of customers representing a credit risk, but for many businesses, it’s the exception and not the rule. Business owners risk ceding much more control by taking on investors for an injection of capital. Myth #4: Invoice factoring is more expensive than traditional financing. Yes, sometimes. Funding from invoice factoring, though, gives you much greater financial leverage—and fast access to working capital when you need it. Factoring fees almost always are more than interest on a line of credit, but if factoring allows you to grow faster and take on more sales, the additional profits should exceed the additional costs. Myth #5: Fees are due up front. If this were true, it would defeat the purpose of invoice factoring, which is to give you immediate access to working capital for your business. Most factoring companies advance a percentage when purchasing your accounts receivable, with the balance paid to you when the company collects on them, less a fee. This gives you access to cash when you need it most. Myth #6: Invoice factoring takes too long. Applying for bank financing can be a lengthy process—and many business owners assume the same about invoice factoring. The reality is that the approval process for invoice factoring is built for speed. Factoring companies understand that their clients are looking for immediate cash. It’s why screening and approval are designed to get you funding as quickly as possible, often within five days, and sometimes faster. Myth #7: You must factor all your invoices. Business owners might assume that they have to turn every one of their accounts receivable over during factoring, but this isn’t the case. Some invoices may be better candidates for factoring than others, as determined by size, days outstanding, and other variables. Factoring can be a one-time financing option or provide ongoing access to capital. Many companies also eventually transition from invoice factoring to traditional bank financing. Myth #8: Invoice factoring will damage my company's reputation. Many business owners are the face of their business, and they might fear the fallout if it appears that another entity is collecting on their behalf. Today, with the rise of third-party vendors that perform treasury management services for businesses, it’s likely to not even raise an eyebrow. In fact, a business’s customers may appreciate streamlined billing and flexible payment terms offered through invoice factoring with the right company. Considering the benefits of factoring your invoices? We can help. Prairie Business Credit is a national working capital provider to young, growing, or recovering businesses. We offer accounts receivable financing, purchase order financing, and equipment financing. Our company serves both as a trusted financial resource and consultant to entrepreneurs dedicated to building their businesses and ensuring their success.

0 Comments

April is Financial Literacy Month in the United States—and it provides an excellent opportunity to review and improve your business finances. First observed in April 2004, Financial Literacy Month is intended to educate people on the principles of finance and planning for a secure financial future. It’s a topic as important for businesses as it is for individuals.

Top financial challenges for businesses Businesses face many financial challenges, from getting started and attaining profitability to navigating the financial demands of various growth phases. According to data from the US Census Bureau, there were over 32.6 million small businesses as of 2018 (the most recent data), and 99.7% of them have 500 or fewer employees. Small businesses power the United States economy, but they face particular financial challenges. Staying in business is one of the biggest: although 80% of small businesses make it through Year 1, nearly half are out of business by the end of Year Five, according to the US Chamber of Commerce. Why? For nearly half, it’s lack of funds—difficulty accessing the working capital needed to meet short-term liabilities and operational expenses, to keep the lights on, people on staff, and the business running. Limited or insufficient cash flow leads to many other financial problems, including missed business opportunities, too much debt, failure to raise capital, poor marketing, missed or late bill payments, and the mixing of personal and business finances. Businesses need access to working capital. Without it, they risk their business growth—and sometimes the business itself. But it’s not always easy to obtain working capital, especially for small, young, or rapidly growing businesses. Traditional lending like bank financing—loans and lines of credit—often have requirements that young or new businesses cannot meet. Or, their terms and repayment schedules make it difficult for small businesses to meet them and remain profitable and growing. Other options may not be better, putting small or young businesses at risk of predatory lenders or at the mercy of venture capital investors who take an equity stake in a growing business. Business owners can benefit from thinking outside the bank for their working capital financing during Financial Literacy Month and at any time all year. Here is what business owners should know about an often-overlooked financing option: factoring. What is factoring? Factoring, also known as invoice factoring, is a financing method based on the purchasing of accounts receivable. A factoring company purchases the unpaid invoices of a business for services already rendered or products already purchased. The factoring company advances funds to the business and then follows up with the customer for payment. When payment is made, the factoring company then pays the business the balance of the invoice less a fee. Who benefits from factoring? Businesses of any size can benefit from factoring when they need access to cash but do not qualify for bank financing. These include situations in which a business has been turned down for bank financing. These reasons can be customer concentration, credit score concerns, insufficient assets or net worth, or being a start-up or new company without a long enough track record to satisfy the bank’s lending requirements. Factoring is an option when delayed invoice payment, a large order, or other unexpected circumstances constrain a business’s access to working capital—at any stage, and for businesses of any size. Established businesses may face challenges when they land new accounts and must fund the rapid growth that can come with large new orders. Factoring can also benefit businesses recovering from a financial setback, helping them regain profitability. In addition, businesses can also realize benefits from factoring by outsourcing management of accounts receivable to a professional factoring company. This can relieve pressure on staff or reduce accounting errors that may delay payment, ultimately helping a business get paid more quickly and be more efficient overall. When should I factor my invoices? Put simply, factor your invoices when the gross margin on the next sale is greater than the cost of factoring, or when your business will save money with trade discounts, reduced administrative costs and collection fees that offset the cost of factoring. Another smart reason to factor is when landing new business—and funding it—through factoring will increase your bottom line. How much does factoring cost? The fee varies by the amount of time it takes to collect the receivables. Typically, the fee ranges from 2-5% of the invoice’s face value. Some factoring companies (like Prairie Business Credit) will only collect the fee when you receive your payment. Does factoring affect my credit rating? Factoring invoices gives businesses access to cash to pay bills, pay down debts, meet operational expenditures, and make investments in growth. This can help businesses improve their credit ratings and take advantage of discounts and better terms from suppliers. Ultimately, these actions can help to accelerate a business’s ability to obtain bank financing in the future. Looking to protect and grow your business with access to working capital? We can help. Prairie Business Credit is a national working capital provider to young, growing, or recovering businesses. We offer accounts receivable financing, purchase order financing, and equipment financing. Our company serves both as a trusted financial resource and consultant to entrepreneurs dedicated to building their businesses and ensuring their success. Everyone has heard the saying, “It takes money to make money.” Business owners know this is true. It takes physical resources like space, materials, and components to produce your products, not to mention the costs of skilled labor, expertise, and administrative support. Moreover, growing a business can require additional working capital, but a young business does not always have easy access to the funds it needs.

What is working capital? Working capital is the money available to meet your business’s immediate and short-term operational expenses—things like payroll, supplier payments, administrative expenses, rent, utilities, and more. It’s calculated by taking current assets and subtracting current liabilities. A shortage in working capital can be a real problem for a business, preventing it from meeting urgent short-term operational expenses. Young, growing businesses face specific working capital shortages—often, they have not been able to secure enough working capital to support the business during its early stages, or during stages of rapid growth. Without enough working capital, a business may miss out on key opportunities. Perhaps there are insufficient funds to invest in new product for a large order, restock inventory, or take advantage of discounted payment terms from suppliers. A working capital shortage can also have worse consequences, like late payments to suppliers or creditors, which can damage credit ratings or even a business’s reputation. It is why business owners are often under pressure to ensure access to working capital. How much working capital does your business need? The answer to this will vary depending on your business, what you sell, and your growth phase. Typically, startup and young businesses should ideally have six to twelve months of operating expenses on hand to meet the short-term needs of this cash-hungry stage. This is because growing businesses face significant investment in staff, certifications or filings, inventory, and other related costs simply to get up and running. More established businesses may find that three to six months’ worth of expenses is enough to handle seasonal fluctuations or slower periods in business. The problem is that the repayment or financing terms of certain working capital options may put a strain on young businesses during this period of rapid growth. If repayment is due before your business is able to generate increased cash, you will remain in a working capital pinch. Many business owners turn to lending options to raise working capital or address a working capital crunch. Here are a few of the most common sources for working capital for young businesses. Working capital options for businesses

There is another option that can provide working capital for young businesses: factoring. Also known as invoice factoring, it is a financing method that can provide fast access to working capital. Businesses sell their unpaid accounts receivable to a factoring company. The factoring company pays an advance and then collects payment on the invoice, paying your business the balance minus a fee. Factoring can solve short-term cash flow crunches, even for start-up or young businesses, or those that face long odds with bank financing because of credit ratings or credit risks. Looking for the best working capital options for young businesses? We can help. Prairie Business Credit is a national working capital provider to young, growing, or recovering businesses. We offer accounts receivable financing, purchase order financing, and equipment financing. Our company serves both as a trusted financial resource and consultant to entrepreneurs dedicated to building their businesses and ensuring their success. Cash flow and access to working capital are two of the biggest headaches for business owners, especially for small, new, or rapidly growing businesses. Why? Often it comes down to how quickly customers pay outstanding invoices. One customer with a slow or late payment—even if the invoice isn’t really large—can create a cashflow crunch. This in turn can lead to other problems, like being late on supplier payments, struggling to make payroll, and missing out on new business opportunities, among others.

You might be thinking: won’t a line of credit solve the problem? Sometimes it does, but sometimes it isn’t the answer. If a business is young, hasn’t secured bank financing, or there’s a creditworthy concern, traditional financing like a line of credit or loan isn’t possible. There’s another answer, though: factoring. This article explains what factoring is, when to consider factoring, and the top reasons your business can benefit from factoring. What is factoring? Factoring, or the purchasing of accounts receivable, is also known as invoice factoring and accounts receivable factoring. Factoring is a financing method that gives businesses quick access to working capital. Businesses sell their unpaid customer invoices for the services they have already performed or products they have already sold. They provide their unpaid invoices to a factoring company, which then provides a cash advance to the business. The factoring company then collects payment from the customer, paying the business the remainder of the invoice amount minus a fee. When should a business factor? There may be many reasons why a business could need to or would benefit from factoring. These can include access to working capital to bring a new product to market, invest in new product, meet the needs of a new or larger customer, compensate for delayed payment, or address a seasonal cash flow fluctuation. Or, a business could be rapidly growing, or have not yet met the requirements for bank financing or other more traditional financing routes. Many businesses do not know about or overlook invoice factoring as an option for short-term financing. Sometimes, though, it’s a wise financial decision. Consider factoring as an option when:

Top 10 reasons to factor your invoices Businesses may overlook or avoid factoring, but factoring invoices can benefit businesses, especially those that need access to working capital, are growing rapidly, or have experienced difficulty with other means of short-term financing. Our Top Ten Reasons to Factor is one of the most popular pieces of content on our site and often answers many questions prospective clients have about factoring. These top reasons to factor your invoices are:

We can help. Prairie Business Credit is a national working capital provider to young, growing, or recovering businesses. We offer accounts receivable financing, purchase order financing, and equipment financing. Our company serves both as a trusted financial resource and consultant to entrepreneurs dedicated to building their businesses and ensuring their success. August 2020, Newsletter A Bridge to Where? When you are looking for a partner to help your customer or prospect get the financing they need, what are you looking for in that partner? If the company is not "bankable," often, that company's trusted advisors help look for a "bridge" lender. Before making that referral, make sure you know where that bridge leads. For the past 26 years, Prairie has been in the business of graduating or providing a bridge to bank financing or self funding. We provide factoring and purchase order financing to growing and recovering businesses. By providing working capital facilities from $20K to $2MM, lending decisions often on the same day an application is received, contracts with no minimum fee requirements or termination penalties, Prairie can get your prospects on a bridge back to you. “Sometimes understanding how well you’re doing running your business can get lost in the noise. When things get busy or tough, it can be easy to ignore your books. But every business owner should put that at the top of the list. Think of it as the scoreboard. Without it, how can you measure the results? Without it, how can you be sure you aren’t being defrauded? Use the great months to know what needs to be repeated and use the down months to learn what needs to be fixed.” - Dylan Morgan, Prairie Business Credit, Executive Vice President What Others Are Saying About Us "Prairie Business Credit quickly assessed an existing borrower's financing needs, and they refinanced us out of that difficult credit. They closed what they proposed, and we've added them to our bank's possible refinance lenders in the Chicagoland marketplace."

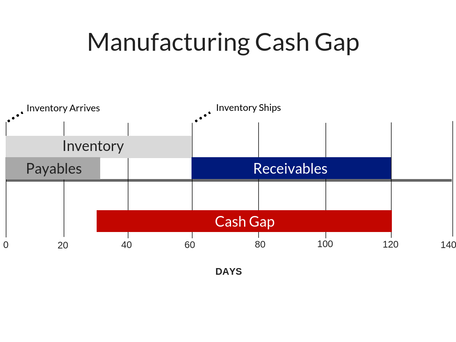

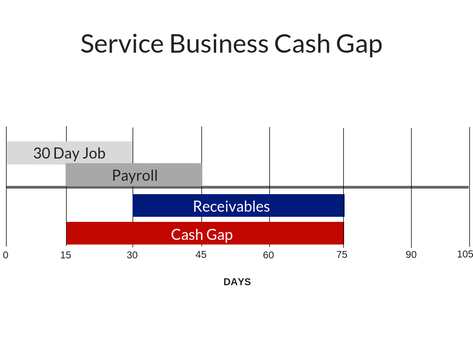

- Bank C&I Workout Leader July 2020, Newsletter Businesses Need to Protect Their Cash Flow During the Pandemic In order to survive as an entrepreneur, optimism is necessary. As we see in the article below, this optimism is still strong in our entrepreneurs, despite the COVID-19 pandemic. However, blind optimism without the proper preparation is more akin to gambling than running a business. So, what happens to a business's cash after a period of lower revenue, and sales start surging? If a company sells to customers and offers terms, as revenues surge, a business could face a severe cash shortfall. In times with steady revenue, a business should expect to collect a consistent amount of cash each week that would equate to the amount of sales they had 6 weeks ago, assuming their customers pay at 6 weeks on average. When a company goes through a sales downturn, it stands to reason that 6 weeks after that, the cash intake will be equivalent to the lower level of sales. As we see in the Manufacturing Cash Gap and Service Business Cash Gap graphics below, the higher inventory and payroll cash needs come much sooner than the increased accounts receivable collections. So as sales grow, cash needs increase and the company is left with less cash coming in the door. This can be a recipe for disaster. A company with well-structured debt should have a line of credit in place for times like these, but what about the companies that don’t or for the company that used that line of credit to get through the shutdown? Factoring could be a great tool for helping them take advantage of surging sales, because factoring allows a company to receive cash when their product or service is delivered instead of waiting that critical 6 weeks. What Others Are Saying About Us “After the downturn, our bank relationship changed. We were getting back on our feet and making payments but we needed cash to meet our customers’ needs. We looked at a lot of lenders. Prairie Business Credit understood manufacturing and they understood our needs. They came up with flexible solutions that helped us with cash flow so we could take orders, even months out. We didn’t lose orders and they helped us manage receivables so we stayed on top of past due accounts. Prairie Business Credit supported us until we could get an SBA loan with a bank."

- Former Client February 2020, Newsletter 13 Week Cash Flow Forecast “Small businesses can stop guessing and get a real handle on their cash position in the near future with this great tool. Many entrepreneurs initially think their cash flow position is very different before they use this method. Knowing how much cash you will have on hand can make the difference between thriving and dying.” - Dylan Morgan, Prairie Business Credit, Executive Vice President What Others Are Saying About Us "We manufacture and resell digital security equipment and software. Venture capitalists offered to fund us, but we wanted to maintain control. Banks wanted a longer track record. When a major retailer selected us for a nationwide rollout, our sales grew from $100,000/month to $1.3 million/month. That's when we called Prairie Business Credit to craft a deal to fund our growth. Now we're securing a commercial bank line for ongoing capital needs. Prairie Business Credit provided the bridge we needed to take our business to the next level." - Former Client When lack of cash keeps you from making the next sale, factoring may be a solution. When the benefits of factoring (including immediate access to cash, and the ability to continue production, make payroll, pay taxes, and/or take advantage of vendor discounts) outweigh the costs of factoring, then factoring should be considered. How to tell:

August's Feature

Advantages of Factoring

July's Feature "If you sell your business, you are no longer in control, regardless of what the buyer promises or implies. So the question you must answer is what is it you really want from your business. Do you want the activity, the accomplishments on your own terms, the pride of ownership because of the good reputation that your customers and vendors associate with you, or do you just want the money to do something else other than be involved in the business you built. It really is a binary choice. It's a simple but hard truth: if you sell, it's not yours anymore." - Trevor Morgan, Founder & CEO, Prairie Business Credit

June's Feature "Leading with the straight forward truth is the best. If you can’t find the money without that, maybe you just aren’t ready. Great ideas always find the money to make it work."

- Dylan Morgan, Executive Vice President, Prairie Business Credit |

Topics

Purchase Order Financing and Factoring How Does Factoring Work? Calculating the Benefits of Factoring When Should You Consider Factoring? Factoring in Five Simple Steps 13 Week Cash Flow Forecast Businesses Need to Protect Their Cash Flow During the Pandemic The Cash Gap Our Second Client Defrauded Us - How it Changed the Way We Do Business Is Prairie Business Credit Expensive? How Much Do They Charge? Top Ten Reasons to Factor You Need Cash for Growth Who are Good Candidates for Factoring? Our Number One Goal is that Our Clients Leave Us A Bridge to Where? In the Age of the Internet, We Still Do Business Face to Face Credit Checks Cash Management Two Fundamental Principles When Giving Your Customers Payment Terms Team Up with a Factor To Earn Lifelong Business Customers Make No Little Plans Prairie Business Credit Promotes Morgan Prairie Business Credit Promotes Diversey Categories |

RSS Feed

RSS Feed